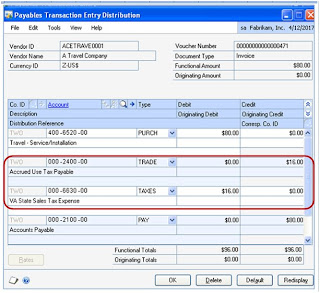

Offset the tax amount in the Trade Discount field.

Point the sales tax Amount to the appropriate expense or tax account.

The Vendor gets paid properly because of the credit and tax gets recorded.

Use SmartLists to track and report use tax data for later remittance [Company > Tax Detail]

No comments:

Post a Comment